Search

CATEGORIES

We found 13 books in our category 'BUSINESS'

We found 42 news items

We found 13 books

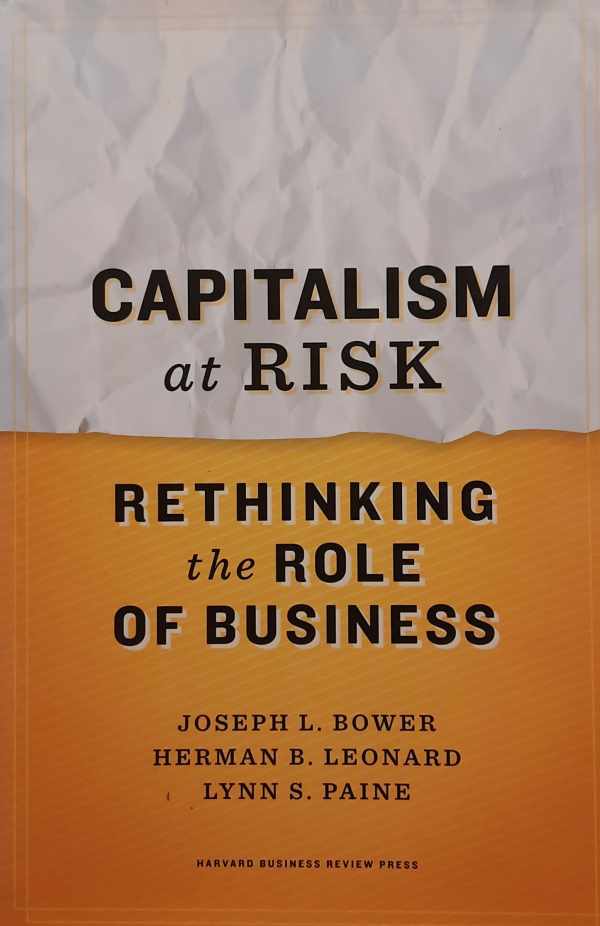

The spread of capitalism worldwide has made people wealthier than ever before. But capitalism's future is far from assured. The global financial meltdown of 2008 nearly produced a great depression. Economies in Europe are still teetering. Income inequality, resource depletion, mass migrations from poor to rich countries, religious fundamentalism--these are just a few of the threats to continuing prosperity. How can capitalism be sustained? And who should spearhead the effort? Critics turn to government. In Capitalism at Risk, Harvard Business School professors Joseph Bower, Herman Leonard, and Lynn Paine argue that while governments must play a role, businesses should take the lead. For enterprising companies--whether large multinationals, established regional players, or small start-ups--the current threats to market capitalism present important opportunities. Capitalism at Risk draws on discussions with business leaders around the world to identify ten potential disruptors of the global market system. Presenting examples of companies already making a difference, the authors explain how business must serve both as innovator and activist--developing corporate strategies that effect change at the community, national, and international levels. Filled with rich insights, Capitalism at Risk presents a compelling and constructive vision for the future of market capitalism.

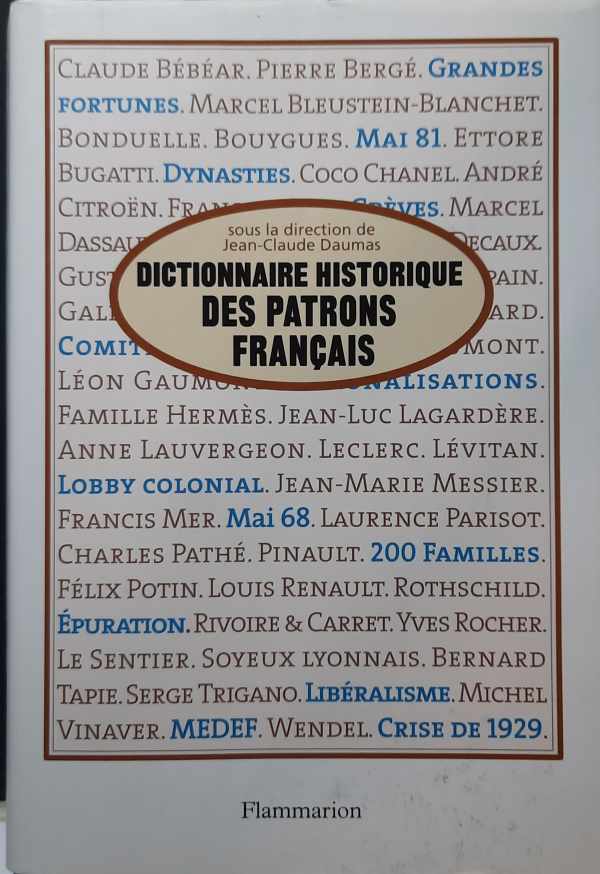

Hardcover, relié, jq, ruban de lecture, in-8, 1614 pp., illustrations, notes bibliographiques, bibliographie, indexes.

Hardcover, relié, jq, ruban de lecture, in-8, 1614 pp., illustrations, notes bibliographiques, bibliographie, indexes. Introduction (pp. 7-18)

I. Hommes, familles et territoires (pp. 19-725)

II. Le monde des patrons (pp. 733-1353)

1. Identités

2. Recrutement et carrière

3. Gestion de l'entreprise

4. Pratiques et enjeux

5. Idées et valeurs

6. Organisations patronales (e.a. MEDEF)

7. Institutions

8. Politique et influence

9. Représentations

10. Evénements (Première Guerre mondiale > Le temps des privatisations)

Quoi de commun entre Jean-Marie Messier, dit " Moi-Même Maître du Monde ", fondateur d'un empire mondialisé de communication, et le directeur d'une fabrique de rubans de Saint-Étienne dans les années 1880 ? entre le dirigeant d'une société d'exportation basée en Indochine et Anne Lauvergeon ? entre la famille Rothschild et Jean Panzani ? Si leurs parcours et leurs vies n'ont rien en commun, ou presque, tous sont des patrons. Première somme consacrée à l'histoire du patronat français au XXe siècle, ce Dictionnaire en offre un tableau inédit. 300 biographies, individuelles ou collectives, mettent en évidence la variété des profils et des trajectoires ; 120 entrées thématiques explorent le monde des patrons, les saisissant dans leur vie privée comme dans leur vie professionnelle, retraçant leurs idées et leurs engagements, ainsi que leur constitution en force collective par le biais des organisations patronales, des années 1880 à nos jours. Réunissant les contributions de 168 historiens, sociologues, politistes et gestionnaires qui comptent parmi les plus grands spécialistes de la question, ce Dictionnaire passionnera quiconque s'intéresse à l'histoire économique de la France, mais aussi tous ceux qui, ayant mille fois croisé leurs patronymes dans les journaux, sur un panneau publicitaire ou au détour d'une allée de supermarché, sont curieux d'apprendre ce qui se cache derrière les noms de Bonduelle, de Citroën ou de Lacoste.

14 februari 2013. Tijdens een persconferentie brengt N-VA-Kamerlid Peter Dedecker een aantal onregelmatigheden aan het licht die de boekhouding van de christelijke arbeidersbeweging ACW ontsieren. Die fiscale onregelmatigheden blijken op de koop toe gelinkt aan het Dexia-debacle: een heikel dossier dat Dedecker dan al een hele tijd op de voet volgt.

De persconferentie is het begin van een scherpe aanklacht tegen de toplui van een sociale beweging die teert op de inzet van duizenden hardwerkende, goedmenende vrijwilligers. De aanklacht omvat al gauw een hele waslijst aan vergrijpen, waaronder schriftvervalsing, fiscale ontwijking en fraude, misbruik van vennootschapsgoederen en belangenvermenging.

Tot grote verbazing van Dedecker zelf, overigens, die vandaag niet anders kan dan besluiten: “De toplui beloofden mensen het veiligste spaarproduct ter wereld. Maar achter hun rug speelden ze met hun spaarcenten in het casino.”

In de weken en maanden erna zat Dedecker in het oog van de storm. Terwijl de pijnlijke onthullingen elkaar maar bleven opvolgen, maakte zijn aanvankelijke verbazing langzaam maar zeker plaats voor een oprechte verontwaardiging en woede. Vanuit die gevoelens besloot hij zich aan het schrijven te zetten.

Het resultaat is ‘Een zuil van zelfbediening’. In dat boek brengt Dedecker nu een reconstructie van zijn persoonlijke ervaringen in die woelige periode, van zijn kennismaking met figuren en praktijken uit de bankwereld, en van zijn speurtocht door het labyrint dat de christelijke arbeidersbeweging blijkt te zijn. Bij gebrek aan een parlementaire onderzoekscommissie kan enkel de geschiedenis de echte (politieke) verantwoordelijkheid voor dit financiële debacle nog blootleggen. Met zijn boek biedt Peter Dedecker zelf alvast een eerste aanzet daartoe.

bron tekst: De Standaard Boekhandel

aanverwante studies

Critique et commentaire Lucas Tessens: Un schéma du groupe aurait été indiqué pour illustrer la complexité du sujet. Il n'est pas clair pour quelle raison l'histoire s'arrête en 1975.

Le groupe Lambert avait beaucoup d'intérêts au Congo, colonie de la Belgique.

Quelques sociétés dans le secteur des médias qui ont attiré notre attention: imprimerie Heliosimp (397), drukkerij Wils à Merksem (457), CIEL-Wils (457), groupe Brébart (457), Periodica (457, sans la mention qu'il s'agit de l'imprimerie principale du groupe De Standaard), CLT (391, 549, 551, 553, 565, 567), Periodica (564, obligations convertibles), Marabout (565), Audiofina (565, 567, 568)

l'Ouvrage à été commandité par Philippe Lambert.

L'actionnariat des entreprises est une donnée fondamentale de l'économie de marché, qu'il soit constitué de grandes familles, de multinationales ou de fonds publics, qu'il soit ou non concentré dans quelques mains, et qu'il concerne le secteur privé ou le secteur public. Par l'apport de capitaux, les actionnaires deviennent tout á la fois les partenaires financiers et les copropriétaires des sociétés dans lesquelles ils investissent. Ä l'échelle d'une région ou d'un pays, ils comptent donc parmi les principaux détenteurs du pouvoir économique.

Réalisé par l'équipe du secteur Économie du CRISP, ce Courrier Hebdomadaire est consacré à la structure de l'actionnariat en Wallonie en 2020. Il fait le point sur trois thématiques : la définition belge de l'entreprlse et la démographie wallonne de celle-ci ; l'évolution de la concentration des entreprises en Wallonie ; la structure de propriété des entreprises wallonnes. Il permet de dégager des tendances claires pour chacun de ces points. L'analyse met en évidence plusieurs réalités de l'économie wallonne, dont la concentration de l'emploi dans un nombre d'entreprises relativement restreint, l'importance des pouvoirs publics belges en termes d'emploi, et le poids des groupes étrangers (essentiellement français, néerlandais, états-uniens, britanniques et allemands) dans l'actionnariat des entreprises de Wallonie. En outre, cette étude permet de prendre la mesure de certaines conséquences de la crise induite par la pandémie de Covid-19 puis de la reprjse économique qui l'a suivie.

Kritische bespreking van tal van schandalen in de beleggingswereld en in de wereld van 'creatief boekhouden'.

2nd edition. Hardcover, dj, in illustrated slipcase, big 4to, 422 pp., illustrations, photos, bibliographical notes, bibliography, index.

2nd edition. Hardcover, dj, in illustrated slipcase, big 4to, 422 pp., illustrations, photos, bibliographical notes, bibliography, index.

Ridder Raynier Ghislain André Marie van Outryve d'Ydewalle (Brussel, 17 december 1934 - Beernem, 10 april 2007) was een Belgisch ambtenaar en bestuurder van vennootschappen. Hij was gedurende bijna 20 jaar voorzitter van de GIMV.

Noot Lucas Tessens:

Omdat ikzelf de basisidee leverde voor Telenet (de aaneenschakeling van de kabelgebieden en het tweewegs maken van de coaxkabel), durf ik hier mijn stoute schoenen aantrekken.

Het hoofdstukje gewijd aan Telenet vertelt maar de halve waarheid en is dus een hele leugen. Ik vraag me trouwens af of VOY wel op de hoogte was van wat er zich in zijn 'huis' aan de Karel Oomsstraat in Antwerpen afspeelde.

De inbreng van US West in het kapitaal van Telenet was van bij het begin een miskleum van jewelste en een voorbode van het verlies van de 'Vlaamse' kabel aan de US-investors en later aan Liberty Global. Wat een parel aan de kroon van Vlaanderen én een moneymaker had kunnen zijn, werd door enkelingen in driedelig pak verkwanseld ! VOY komt met wat neoliberaal gewauwel aandraven om een mistige operatie goed te praten. Stefaan Michielsen heeft dat, blijkbaar zonder wederwoord, zonder 'double check' of kritische noot, braafjes neergepend. Want daar dienen huurlingen-journalisten toch voor, nietwaar.

zie het relaas dat wij in 1997 aan Trends Top Informatica leverden

We found 42 news items

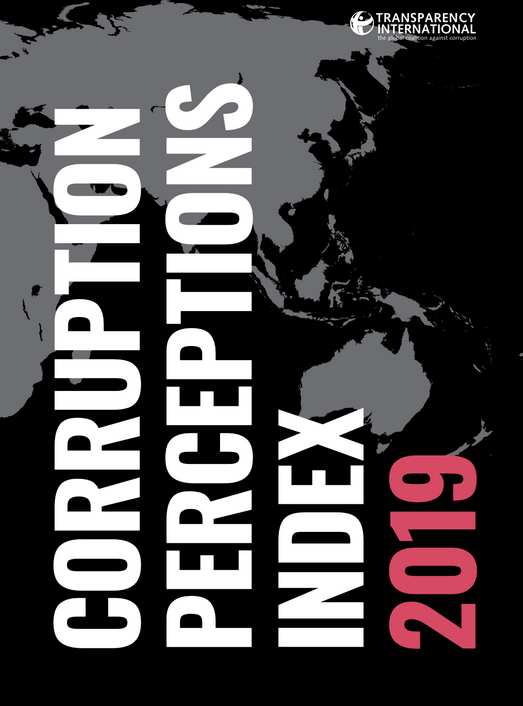

The Corruption Perceptions Index 2019 reveals a staggering number of countries are showing little to no improvement in tackling corruption. Our analysis also suggests that reducing big money in politics and promoting inclusive political decision-making are essential to curb corruption. The CPI scores 180 countries and territories by their perceived levels of public sector corruption, according to experts and business people.

The Corruption Perceptions Index 2019 reveals a staggering number of countries are showing little to no improvement in tackling corruption. Our analysis also suggests that reducing big money in politics and promoting inclusive political decision-making are essential to curb corruption. The CPI scores 180 countries and territories by their perceived levels of public sector corruption, according to experts and business people.In the last year, anti-corruption movements across the globe gained momentum as millions of people joined together to speak out against corruption in their governments. Protests from Latin America, North Africa and Eastern Europe to the Middle East and Central Asia made headlines as citizens marched in Santiago, Prague, Beirut, and a host of other cities to voice their frustrations in the streets. From fraud that occurs at the highest levels of government to petty bribery that blocks access to basic public services like health care and education, citizens are fed up with corrupt leaders and institutions. This frustration fuels a growing lack of trust in government and further erodes public confidence in political leaders, elected officials and democracy. The current state of corruption speaks to a need for greater political integrity in many countries. To have any chance of curbing corruption, governments must strengthen checks and balances, limit the influence of big money in politics and ensure broad input in political decision-making. Public policies and resources should not be determined by economic power or political influence, but by fair consultation and impartial budget allocation.

Billionaire fortunes increased by 12 percent last year – or $2.5 billion a day - while the 3.8 billion people who make up the poorest half of humanity saw their wealth decline by 11 percent, reveals a new report from Oxfam today. The report is being launched as political and business leaders gather for the World Economic Forum in Davos, Switzerland.

‘Public Good or Private Wealth’ shows the growing gap between rich and poor is undermining the fight against poverty, damaging our economies and fuelling public anger across the globe. It reveals how governments are exacerbating inequality by underfunding public services, such as healthcare and education, on the one hand, while under taxing corporations and the wealthy, and failing to clamp down on tax dodging, on the other. It also finds that women and girls are hardest hit by rising economic inequality.

Winnie Byanyima, Executive Director of Oxfam International, said:

“The size of your bank account should not dictate how many years your children spend in school, or how long you live – yet this is the reality in too many countries across the globe. While corporations and the super-rich enjoy low tax bills, millions of girls are denied a decent education and women are dying for lack of maternity care.”

The report reveals that the number of billionaires has almost doubled since the financial crisis, with a new billionaire created every two days between 2017 and 2018, yet wealthy individuals and corporations are paying lower rates of tax than they have in decades.

Getting the richest one percent to pay just 0.5 percent extra tax on their wealth could raise more money than it would cost to educate the 262 million children out of school and provide healthcare that would save the lives of 3.3 million people.

Just four cents in every dollar of tax revenue collected globally came from taxes on wealth such as inheritance or property in 2015. These types of tax have been reduced or eliminated in many rich countries and are barely implemented in the developing world.

Tax rates for wealthy individuals and corporations have also been cut dramatically. For example, the top rate of personal income tax in rich countries fell from 62 percent in 1970 to just 38 percent in 2013. The average rate in poor countries is just 28 percent.

In some countries, such as Brazil, the poorest 10 percent of society are now paying a higher proportion of their incomes in tax than the richest 10 percent.

At the same time, public services are suffering from chronic underfunding or being outsourced to private companies that exclude the poorest people. In many countries a decent education or quality healthcare has become a luxury only the rich can afford. Every day 10,000 people die because they lack access to affordable healthcare. In developing countries, a child from a poor family is twice as likely to die before the age of five than a child from a rich family. In countries like Kenya a child from a rich family will spend twice as long in education as one from a poor family.

Cutting taxes on wealth predominantly benefits men who own 50 percent more wealth than women globally, and control over 86 percent of corporations. Conversely, when public services are neglected poor women and girls suffer most. Girls are pulled out of school first when the money isn’t available to pay fees, and women clock up hours of unpaid work looking after sick relatives when healthcare systems fail. Oxfam estimates that if all the unpaid care work carried out by women across the globe was done by a single company it would have an annual turnover of $10 trillion – 43 times that of Apple, the world’s biggest company.

“People across the globe are angry and frustrated. Governments must now deliver real change by ensuring corporations and wealthy individuals pay their fair share of tax and investing this money in free healthcare and education that meets the needs of everyone - including women and girls whose needs are so often overlooked. Governments can build a brighter future for everyone – not just a privileged few,” added Byanyima.

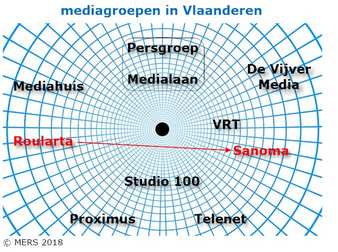

Het beursgenoteerde Roularta Media Group heeft een bindend bod uitgebracht op de Belgische Sanoma-titels met uitzondering van de woonbladen. Het pakket omvat de weekbladen Libelle/Femme d’Aujourd’hui (CIM 245.504 exemplaren) en Flair N/F (CIM 74.222 exemplaren), de maandbladen Feeling/Gaël (CIM 69.132 exemplaren) en de magazines La Maison Victor, Communiekrant, Loving You en She Deals. De websites (met o.a. flair.be en libelle.be met respectievelijk 804.135 en 600.841 real users/maand volgens CIM), line extensions en social mediakanalen van deze titels zijn eveneens in het bod opgenomen. De totale 2017 omzet van deze merken bedraagt circa 78 miljoen euro voor een overnameprijs (inclusief pensioen- en abonnementenverplichting) van 33.7 mio euro.

De (offline/online) doelgroepen van die mediamerken zijn uitgesproken vrouwelijk en dus een mooie aanvulling op de reeds bestaande andere hoogkwalitatieve doelgroepen die bereikt worden via de huidige magazinemerken van Roularta (Knack, Le Vif, Trends, Sportmagazine, Nest, Plus Magazine enz.).

Naar aanleiding van deze belangrijke transactie, verkoopt Roularta de titels “Ik ga Bouwen/ Je vais Construire” voor een prijs van 1 miljoen euro aan Sanoma, die in mindering komt van de overnameprijs voor de Sanoma titels. Het zijn titels die aansluiten bij het portfolio woon- en decobladen van Sanoma.

Roularta wil door deze consolidatie en dankzij de synergie met de magazinemerken van de groep, zorgen voor de continuïteit en de multimediale groei van deze titels.

Indien het bod goedgekeurd wordt door Sanoma, zal de transactie voorgelegd worden aan de Belgische mededingingsautoriteiten .

Vooruitzichten

In 2017 heeft Roularta Media Group te maken gehad met een daling van de reclamebestedingen, met de kosten van de investeringen in de lancering van nieuwe projecten zoals het e-commerceplatform Storesquare en met andere éénmalige kosten. Roularta verwacht dan ook een negatieve EBIT. Voor het boekjaar 2017 wordt geen dividend voorzien.

In 2018 zorgen lagere kosten, de nieuwe 50% participatie in Mediafin (Tijd/Echo), de recente acquisities Landleven (Nederland) en Sterck (Antwerpen en Limburg) en de andere nieuwe activiteiten, voor een positieve bijdrage.

Daarenboven wordt voor 2018 verwacht dat een belangrijke meerwaarde wordt geboekt van ongeveer 145 miljoen euro op de aandelen Medialaan, na de closing van de transactie in het eerste kwartaal.

Vanaf 2019 dalen voor Roularta de financiële kosten met ongeveer 4,5 miljoen door de terugbetaling van een obligatielening van 100 miljoen euro en dalen de leasingkosten met ongeveer 9 miljoen door de afronding van de Econocom-contracten.

Roularta Media Group heeft belangrijke toekomstkeuzes gemaakt door in te zetten op consolidatie en innovatie binnen het kader van haar kernactiviteiten. Na het afstaan van de Medialaan 50%-participatie aan de Persgroep is de beoogde mogelijke overname van de Sanoma-titels, naast de investering in Mediafin en de andere recente overnames, een belangrijke aanzet om ook de komende jaren verder een gezonde groei te realiseren.

aandeelhouders RMG

Uit het persbericht van Sanoma Group, Helsinki:

“We have now finalized our major portfolio restructuring in our Media business in the Netherlands and Belgium with the divestment of the Dutch SBS TV business last year, and now the Belgian women’s magazine titles. The Belgian magazine titles will have more synergies with RMG than with our Dutch magazine business and that will give these titles and the team working on them better prospects for future development. Our remaining magazine and online portfolio predominantly in the Dutch market has good market positions, which provide excellent opportunities for continued success,” says Susan Duinhoven, President and CEO of Sanoma.

Wij roepen u op om de verkoop, handel en export van onbewerkt ivoor per direct te verbieden. De overlevingskans van wilde olifanten hangt af van het per direct sluiten van Hong Kongs ivoormarkt!

Hong Kongs ivoorhandel heeft een treurig dieptepunt bereikt: voor één scheepslading werden 1000(!) olifanten gedood. En dat allemaal voor snuisterijen op een boekenplank.

Hong Kong is een soort olifantenkerkhof -- waar de handel in hun lichaamsdelen booming business is. En zolang dat legaal is zullen nog veel van deze adembenemende dieren sneuvelen -- ze zouden zelfs over 10 jaar van de aardbodem verdwenen kunnen zijn!

De overheid van Hong Kong wil deze bloederige handel nu verbieden, maar lobbyisten gooien alles in de strijd om dit tegen te houden. Als wij ons allemaal uitspreken kunnen we de lobbyisten overstemmen, en de overheid de steun geven die ze nodig heeft. Dit zou duizenden olifanten kunnen redden.

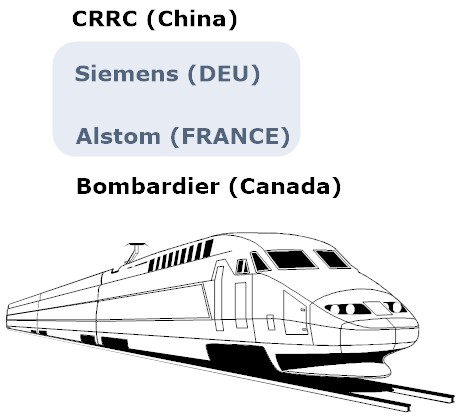

Volgens de 1M van Frankrijk, Edouard Philippe, moet de fusie leiden tot een grotere Europese rail-groep die moet kunnen opboksen tegen de concurrentie van China.

Commentaar: Ik zie niet in hoe een schaalvergroting een voordeel zou kunnen zijn, gegeven de significant lagere productiekosten in China. Het conglomeraat Siemens/Alstom wordt eerder een aantrekkelijker prooi voor de grote appetijt van de Chinese investeerders (of Big Players die zich voor Chinezen laten doorgaan). En dus is het best mogelijk dat Siemans/Alstom binnen enkele jaren opgeslokt wordt door het netwerk van de Big Players.

Hieronder het perspericht van Alstom, vrijgegeven op 26/9/2017.

Siemens and Alstom join forces to create a European Champion in Mobility

26/09/2017

Signed Memorandum of Understanding grants exclusivity to combine mobility businesses in a merger of equals

Listing in France and group headquarters in Paris area; led by Alstom CEO with 50 percent shares of the new entity owned by Siemens

Business headquarter for Mobility Solutions in Germany and for Rolling Stock in France

Comprehensive offering and global presence will offer best value to customers all over the world

Combined company’s revenue €15.3 billion, adjusted EBIT of €1.2 billion

Annual synergies of €470 million expected latest four years after closing

Today, Siemens and Alstom have signed a Memorandum of Understanding to combine Siemens’ mobility business including its rail traction drives business with Alstom. The transaction brings together two innovative players of the railway market with unique customer value and operational potential. The two businesses are largely complementary in terms of activities and geographies. Siemens will receive newly issued shares in the combined company representing 50 percent of Alstom’s share capital on a fully diluted basis.

“This Franco-German merger of equals sends a strong signal in many ways. We put the European idea to work and together with our friends at Alstom, we are creating a new European champion in the rail industry for the long term. This will give our customers around the world a more innovative and more competitive portfolio”, said Joe Kaeser, President and CEO of Siemens AG. “The global market-place has changed significantly over the last few years. A dominant player in Asia has changed global market dynamics and digitalization will impact the future of mobility. Together, we can offer more choices and will be driving this transformation for our customers, employees and shareholders in a responsible and sustainable way”, Kaeser added.

“Today is a key moment in Alstom’s history, confirming its position as the platform for the rail sector consolidation. Mobility is at the heart of today’s world challenges. Future modes of transportation are bound to be clean and competitive. Thanks to its global reach across all continents, its scale, its technological know-how and its unique positioning on digital transportation, the combination of Alstom and Siemens Mobility will bring to its customers and ultimately to all citizens smarter and more efficient systems to meet mobility challenges of cities and countries. By combining Siemens Mobility’s experienced teams, complementary geographies and innovative expertise with ours, the new entity will create value for customers, employees and shareholders,” said Henri Poupart-Lafarge, Chairman and Chief Executive Officer of Alstom SA. “I am particularly proud to lead the creation of such a group which will undoubtedly shape the future of mobility.”

The new entity will benefit from an order backlog of €61.2 billion, revenue of €15.3 billion, an adjusted EBIT of €1.2 billion and an adjusted EBIT-margin of 8.0 percent, based on information extracted from the last annual financial statements of Alstom and Siemens. In a combined setup, Siemens and Alstom expect to generate annual synergies of €470 million latest in year four post-closing and targets net-cash at closing between €0.5 billion to €1.0 billion. Global headquarters as well as the management team for rolling stock will be located in Paris area and the combined entity will remain listed in France. Headquarters for the Mobility Solutions business will be located in Berlin, Germany. In total, the new entity will have 62,300 employees in over 60 countries.

As part of the combination, Alstom existing shareholders at the close of the day preceding the closing date, will receive two special dividends: a control premium of €4.00 per share (in total = €0.9 billion) to be paid shortly after closing of the transaction and an extraordinary dividend of up to €4.00 per share (in total = €0.9 billion) to be paid out of the proceeds of Alstom’s put options for the General Electric joint ventures of approximately €2.5 billion subject to the cash position of Alstom. Siemens will receive warrants allowing it to acquire Alstom shares representing two percentage points of its share capital that can be exercised earliest four years after closing.

The businesses of the two companies are largely complementary. The combined entity will offer a significantly increased range of diversified product and solution offerings to meet multi-facetted, customer-specific needs, from cost-efficient mass-market platforms to high-end technologies. The global footprint enables the merged company to access growth markets in Middle East and Africa, India, and Middle and South America where Alstom is present, and China, United States and Russia where Siemens is present. Customers will significantly benefit from a well-balanced larger geographic footprint, a comprehensive portfolio offering and significant investment into digital services. The combination of know-how and innovation power of both companies will drive crucial innovations, cost efficiency and faster response, which will allow the combined entity to better address customer needs.

The Board of Directors of the combined group will consist of 11 members and will be comprised of 6 directors designated by Siemens, one of which being the Chairman, 4 independent directors and the CEO. In order to ensure management continuity, Henri Poupart-Lafarge, will continue to lead the company as CEO and will be a board member. Jochen Eickholt, CEO of Siemens Mobility, shall assume an important responsibility in the merged entity. The corporate name of the combined group will be Siemens Alstom.

The envisaged transaction is unanimously supported by Alstom’s board (further to a review process of the preparation of the transaction by the Audit Committee acting as an ad hoc committee) and Siemens’s supervisory board. Bouygues fully supports the transaction and will vote in favor of the transaction at the Alstom’s board of directors and at the extraordinary general meeting deciding on the transaction to be held before July 31, 2018, in line with Alstom board of director decision. The French State also supports the transaction based on undertakings by Siemens, including a standstill at 50.5 percent of Alstom’s share capital for four years after closing and certain governance and organizational and employment protections. The French State confirms that the loan of Alstom shares from Bouygues SA will be terminated in accordance with its terms no later than October 17, 2017 and that it will not exercise the options granted by Bouygues. Bouygues has committed to keep its shares until the earlier of the extraordinary general meeting deciding on the transaction and July 31, 2018.

In France, Alstom and Siemens will initiate Works Councils’ information and consultation procedure according to French law prior to the signing of the transaction documents. If Alstom were not to pursue the transaction, it would have to pay a €140 million break-fee. The transaction will take the form of a contribution in kind of the Siemens Mobility business including its rail traction drives business to Alstom for newly issued shares of Alstom and will be subject to Alstom’s shareholders’ approval, including for purposes of cancelling the double voting rights, anticipated to be held in the second quarter of 2018. The transaction is also subject to clearance from relevant regulatory authorities, including foreign investment clearance in France and anti-trust authorities as well as the confirmation by the French capital market authority (AMF) that no mandatory takeover offer has to be launched by Siemens following completion of the contribution. Closing is expected at the end of calendar year 2018.

de geschiedenis van Siemens

histoire d'Alstom France

Er verschijnt bij Racine ook een boek over de business van de adel:

Noblesse is business. Une vaste enquête menée au coeur du patrimoine et des réseaux de la noblesse belge par Serge Quoidbach, Michel Lauwers et Nicolas Keszei

zie ook het referentiewerk van professor Paul Janssens

Abdullah Bozkurt

Abdullah BozkurtThe plain, simple and bitter truth is that Turkey’s Islamist rulers have supported and maintained parallel networks in Europe; thrown political, diplomatic and financial support to front NGOs whose role is to promote hatred; and run a campaign of intimidation and curtailed free speech in European nations that are home to large Turkish and Muslim expatriate communities.

Delivering a very passionate speech last month at the European Parliament, Guy Verhofstadt, president of the Alliance of Liberals and Democrats for Europe, called this a fifth column that is being operated by the cronies of autocratic president Recep Tayyip Erdoğan to undermine Europe from within. He called on lawmakers to fight for European values and send a strong message to Erdoğan by freezing the accession talks with Turkey, which will most likely threaten this autocrat’s economic lifeline.

Turkey’s top Islamist has been secretly organizing clandestine networks in Europe to extend his influence and to create a network of supporters among Turkish and Muslim communities (especially from Egypt, Syria, Somalia and the Balkans) that could be called to serve the political goals of Erdogan. Just last week, we saw how this network was mobilized by Erdoğan in Germany, Belgium, Austria and Luxembourg where crowds gathered to show their support for this autocrat’s goals. The drive ran in parallel with similar rallies held by youth and women’s branches of the ruling Justice and Development Party (AKP) in front of the embassies of these countries in Ankara. With this showdown, Erdoğan hopes that the EU will give in on critical issues where the EU has shown resistance.

As opposed to a constructive engagement that would help Turkish and Muslim immigrant communities to better integrate with host nations, Erdoğan’s plan is rather based on playing a “spoiler card” in the heart of Europe by creating a groundswell of public support that will be difficult to restrain when push comes to shove. For that, he funds shell companies to run the fuel line for these networks and even pours in cash from a secret stash of state discretionary funds using the diplomatic pouch. It is not surprising to see that some European politicians including several EU lawmakers were hooked by this. Some have already been exposed by name and shamed publicly, while others are waiting their turn as confidential investigations close in. These Erdoğan apologists, who are now paying their dues by taking a position against his critics and opponents, will be sidelined and marginalized.

The heavyweights in Erdoğan’s fifth column in Europe comprise three major organizations that were set up on political and religious grounds to cater to different constituencies. There are hundreds of other NGOs clustered around these big boys that move in unison when given orders. In addition to raising funds and local recruitment, they are well financed by the Turkish government and supported diplomatically and politically. To volunteers they offer perks such as facilitation of their business and family dealings in the motherland, or positions in the Turkish government or government-linked institutions for their relatives. For Erdoğan critics, they run an intimidation campaign by profiling them and alerting authorities back in Turkey so that friends and families face repression and even jail time.

The easiest way to discern the pattern among these NGOs and Erdoğan’s political machinations is by looking at how they quickly pile on when Erdoğan wants. The first organization is the Union of European Turkish Democrats (UETD), founded in Germany in 2004 but later expanded to other European countries — France, Belgium, Austria, Netherlands and the UK. It has been totally transformed into an Islamist grassroot base for Erdoğan. The organization, working closely with Turkish embassies, is an important vehicle in delivering results for Erdoğan from get-out-to-vote campaigns to lobbying activities in European capitals. Turkish government officials are encouraged to spare time to meet and attend events organized by the UETD when they go to Europe. President Erdoğan’s travel itinerary often includes a meeting with UETD officials on the sidelines of his official visits.

While the UETD focuses exclusively on Turkish expat communities, the Union of NGOs of the Islamic World (UNIW), another NGO set up by Turkish Islamist rulers in 2005, actively works among Muslim communities in Europe and other continents. Among its members are controversial charity groups such as International Humanitarian Relief (IHH), accused of arms smuggling to rebels in Syria, and the Ensar Foundation, which was involved in a spree of rapes of dozens of children in the conservative Turkish district of Karaman. Erdoğan orchestrated the coverup of criminal investigations into both and protected them from prosecution. The UNIW has been running various schemes in Europe, linking up with Muslim groups in order to secure their loyalty to the undeclared Caliph Erdoğan.

The leaked emails of Erdoğan’s son-in-law Berat Albayrak, authenticated inadvertently by a court complaint, revealed that both the UETD and UNIW have worked together in Europe to promote goals set up by the Erdoğan family. In an email dated Jan. 21, 2013 and sent to Albayrak, a man named İsmail Emanet, then head of the youth branches of the UNIW, sent a detailed report to Erdoğan’s son-in-law on activities in Europe. In the 19-page report, Emanet, who is now advisor to Energy Minister Albayrak, said the UETD must be overhauled to better realign with the Islamist government’s goals and suggested that the Turkish-Islamic Union for Religious Affairs (DİTİB), the wealthy organization that is run by imams and was sent by the Turkish government to Europe, work closely with the UETD.

The DİTİB, which used be an apolitical religious network that was relied upon by secular governments in the past, has for some time now been transformed into an instrument of hate-mongering and anti-Western political machinations by President Erdoğan. With its control of so many mosques in Europe and the huge financial resources at its disposal, the DİTİB presents serious challenges to the integration policies of all European countries that host sizable Turkish communities. In November 2015, the UETD awarded DİTİB-affiliated imams in Germany certificates of appreciations for their role in the Nov. 1 elections, which restored the parliamentary majority to Erdoğan’s AKP.

As European politicians are hobbled by internal divisions, Erdoğan sees a moment of opportunity to advance his fifth column in the heart of Europe. Using the front NGOs and transformed grassroot networks, his intelligence operatives have stepped up their intel collection efforts, run clandestine schemes, plan false flags and even plot assassinations and murders of dissidents and critics. Using the migrant deal to blackmail the EU, Erdoğan is twisting arms and threatens Europe with a flood of refugees. It is not hard to imagine what he is planning secretly.

With this trajectory of boosting radicals and hooligans among the Turkish and Muslim communities of Europe, Turkey’s Islamists have set relations with the EU back further. What is more troubling is that Erdoğan’s xenophobic and anti-Western policies give more ammunition to far-right Islamophobic European politicians at the expense of moderate conservatives, liberals and social democrats. In other words, Erdoğan is undermining European values not just by advancing the fifth column of Islamist zealotry in the midst of Europe but also by giving a huge impetus to the extreme right. In the meantime law-abiding and peaceful Turks and Muslims in Europe find themselves under greater suspicion from the larger majority because of closer scrutiny as European authorities are scrambling to defuse the risk of Erdoğan’s fifth column from developing effectively.

As a result, Turkey’s autocratic president has not only migrants to mobilize in order to destabilize Europe but also an Islamist fifth column in the heart of Europe to march forward when the time comes. The militant religious networks are already mushrooming in Europe on fertile ground provided by this fifth column’s clandestine activities.

The situation is similar in Sweden where 43.8 percent of ultra high net worth individuals inherited their fortune. In the United Kingdom and the United States however, the story is quite different with the vast majority of wealthy individuals starting off from scratch without familial assistance. In Russia where oil has produced countless billionaires since the collapse of communism, inheriting vast sums of money is far rarer: a mere 1.3 percent of super-rich individuals in Russia netted their wealth through inheritance.

Looking for job security in the knowledge economy? Just learn to code. At least, that’s what we’ve been telling young professionals and mid-career workers alike who want to hack it in the modern workforce—in fact, it’s advice I’ve given myself. And judging by the proliferation of coding schools and bootcamps we’ve seen over the past few years, not a few have eagerly heeded that instruction, thinking they’re shoring up their livelihoods in the process.

Unfortunately, many have already learned the hard way that even the best coding chops have their limits. More and more, "learn to code" is looking like bad advice.

CODING CAN’T SAVE YOU

Anyone competent in languages such as Python, Java, or even web coding like HTML and CSS, is currently in high demand by businesses that are still just gearing up for the digital marketplace. However, as coding becomes more commonplace, particularly in developing nations like India, we find a lot of that work is being assigned piecemeal by computerized services such as Upwork to low-paid workers in digital sweatshops.

This trend is bound to increase. The better opportunity may be to use your coding skills to develop an app or platform yourself, but this means competing against thousands of others doing the same thing—and in an online marketplace ruled by just about the same power dynamics as the digital music business.

Besides, learning code is hard, particularly for adults who don’t remember their algebra and haven’t been raised thinking algorithmically. Learning code well enough to be a competent programmer is even harder.

Although I certainly believe that any member of our highly digital society should be familiar with how these platforms work, universal code literacy won’t solve our employment crisis any more than the universal ability to read and write would result in a full-employment economy of book publishing.

It’s actually worse. A single computer program written by perhaps a dozen developers can wipe out hundreds of jobs. As the author and entrepreneur Andrew Keen has pointed out, digital companies employ 10 times fewer people per dollar earned than traditional companies. Every time a company decides to relegate its computing to the cloud, it's free to release a few more IT employees.

Most of the technologies we're currently developing replace or obsolesce far more employment opportunities than they create. Those that don’t—technologies that require ongoing human maintenance or participation in order to work—are not supported by venture capital for precisely this reason. They are considered unscalable because they demand more paid human employees as the business grows.

TRAINING OUR ROBO-REPLACEMENTS

Finally, there are jobs for those willing to assist with our transition to a more computerized society. As employment counselors like to point out, self-checkout stations may have cost you your job as a supermarket cashier, but there’s a new opening for that person who assists customers having trouble scanning their items at the kiosk, swiping their debit cards, or finding the SKU code for Swiss chard. It’s a slightly more skilled job and may even pay better than working as a regular cashier.

But it’s a temporary position: Soon enough, consumers will be as proficient at self-checkout as they are at getting cash from the bank machine, and the self-checkout tutor will be unnecessary. By then, digital tagging technology may have advanced to the point where shoppers just leave stores with the items they want and get billed automatically.

For the moment, we’ll need more of those specialists than we’ll be able to find—mechanics to fit our current cars with robot drivers, engineers to replace medical staff with sensors, and to write software for postal drones. There will be an increase in specialized jobs before there's a precipitous drop. Already in China, the implementation of 3-D printing and other automated solutions is threatening hundreds of thousands of high-tech manufacturing jobs, many of which have existed for less than a decade.

American factories would be winning back this business but for a shortage of workers with the training necessary to run an automated factory. Still, this wealth of opportunity will likely be only temporary. Once the robots are in place, their continued upkeep and a large part of their improvement will be automated as well. Humans may have to learn to live with it.

HIGH-TECH UNEMPLOYMENT

This conundrum was first articulated back in the 1940s by the cybernetics pioneer Norbert Wiener, whose work influenced members of the Eisenhower Administration to start worrying about what would come after industrialism. By 1966, the United States convened the first and only sessions of the National Commission on Technology, Automation, and Economic Progress, which published six (mostly ignored) volumes sizing up what would later be termed the "post-industrial economy."

Today, it’s MIT’s Erik Brynjolfsson and Andrew McAfee who appear to be leading the conversation about technology’s impact on the future of employment—what they call the "great decoupling." Their extensive research shows, beyond reasonable doubt, that technological progress eliminates jobs and leaves average workers worse off than they were before.

Yet it’s hard to see this great decoupling as a mere unintended consequence of digital technology. It is not a paradox but the realization of the industrial drive to remove humans from the value equation. That’s the big news: The growth of an economy does not mean more jobs or prosperity for the people living in it.

"I would like to be wrong," a flummoxed McAfee confided in the same article, "but when all these science-fiction technologies are deployed, what will we need all the people for?"

When technology increases productivity, a company has a new excuse to eliminate jobs and use the savings to reward its shareholders with dividends and stock buybacks. What would've been lost to wages is instead turned back into capital. So the middle class hollows out, and the only ones left making money are those depending on the passive returns from their investments.

It turns out that digital technology merely accelerates this process to the point where we can all see it occurring. It's just that we haven't all taken notice yet—we’ve been busy coding.

"It’s the great paradox of our era," Brynjolfsson explained to MIT Technology Reviewin 2013. "Productivity is at record levels, innovation has never been faster, and yet at the same time, we have a falling median income and we have fewer jobs. People are falling behind because technology is advancing so fast and our skills and organizations aren’t keeping up."

[This post is based on Douglas Rushkoff’s new book, Throwing Rocks at the Google Bus: How Growth Became the Enemy of Prosperity and originally appeared in Fast Company.]

Mumbai: The Tata Steel board today reviewed the recent performance of the European business of the company, more specifically, of Tata Steel UK. It noted with deep concern the deteriorating financial performance of the UK subsidiary in the last twelve months. While the global steel demand, especially in developed markets like Europe has remained muted following the financial crisis of 2008, trading conditions in the UK and Europe have rapidly deteriorated more recently, due to structural factors including global oversupply of steel, significant increase in third country exports into Europe, high manufacturing costs, continued weakness in domestic market demand in steel and a volatile currency. These factors are likely to continue into the future and have significantly impacted the long term competitive position of the UK operations in spite of several initiatives undertaken by the management and the workers of the business in recent years. Even under these adverse market conditions, the Tata Steel has extended substantial financial support to the UK business and suffered asset impairment of more than £2 billion in the last five years.

The Tata Steel board also reviewed the proposed restructuring and transformation plan for Strip Products UK, prepared by the European subsidiary in consultation with an independent and internationally reputed consultancy firm. Based on the review conducted, the Tata Steel board came to a unanimous conclusion that the plan is unaffordable, requires material funding support in the next two years in addition to significant capital commitments over the long term, the assumptions behind it are inherently very risky, and its likelihood of delivery is highly uncertain. Therefore, the board concluded that it would not be able to support the investment necessary to proceed with the proposed Strip Products UK transformation plan.

The company has also been in deep engagement with the UK government in recent months seeking its support to achieve the best possible outcome for the UK business, within the restrictions of State Aid Rules and other statutory limits. These discussions are ongoing and will continue. Discussions will also continue with Greybull in relation to a sale of the UK Long Products business. The UK government is also involved in the latter discussions.

Following the strategic view taken by the Tata Steel board regarding the UK business, it has advised the board of its European holding company ie Tata Steel Europe, to explore all options for portfolio restructuring including the potential divestment of Tata Steel UK, in whole or in parts. Given the severity of the funding requirement in the foreseeable future, the Tata Steel Europe board will be advised to evaluate and implement the most feasible option in a time bound manner.

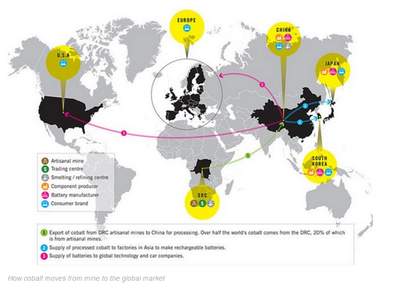

Amnesty believes the issue is that none of these companies can actually verify where the cobalt comes from. But “around half of all cobalt comes from the DRC, and no company can validly claim that they are unaware of the human rights and child labor abuses linked with mineral extraction in the region,” business and human rights researcher at Amnesty International, Mark Dummett, told the Guardian.

find out more

Belgium has been ordered to recover $765 million in unpaid taxes from 35 multinational corporations after the European Commission said tax breaks granted to the companies were illegal.

The ruling was the latest in a series of investigations, led by European Union competition commissioner Margrethe Vestager, into special tax concessions offered by European countries to lure the business of multinational corporations.

Last year the commission made similar rulings against Luxembourg and the Netherlands concerning their tax deals with Fiat and Starbucks respectively. Investigations into Ireland’s tax arrangements with Apple and Luxembourg’s agreement with Amazon are ongoing.

The commission has not named the 35 companies affected by the Belgium ruling, but brewer ABInBev (which produces Budweiser, Stella Artois and other popular brands of beer) and BP are reported to be among them.

ICIJ’s Luxemourg Leaks investigation, published in 2014, revealed the inner workings of many of these types of secret arrangements that some of the world’s biggest companies make with government authorities in order to slash their tax bills.

On the same day the commission’s latest ruling was announced, an interview with commissioner Vestager was published by EurActiv in which she denounced Luxembourg’s decision to prosecute two whistleblowers and a journalist in relation to leaked tax documents.

“LuxLeaks could not have happened if it was not for the whistleblower and the team of investigative journalists. The two worked very well together to change the momentum of the debate about corporate taxation in Europe,” Vestager said.

“I think everyone should thank both the whistleblower and the investigative journalists who put a lot of work into this.”

The trial of whistleblower and former PricewaterhouseCoopers employee Antoine Deltour, another unnamed whistleblower, and journalist and ICIJ member Edouard Perrin is set to begin in Luxembourg on April 26.

America

On September 28th, 2015, we wrote of the driving factor behind increased market volatility, “excessive debt, prime and subprime with no liquidity, a reminder of 2007-2008.” It is clear that new, small, and medium sized businesses can not finance or refinance in such an environment. A recovery propelled by business growth is impossible in the current debt environment. In 2006 63.4% of the U.S. population over 16 years of age was employed. Entering 2016, 59.5% of the population is employed. In constant dollars from 2006 to the present average hourly wages have remained at approximately $20.50 while real (inflation adjusted) mean household income of the middle quadrille has hovered at about $54,000 per annum. Poverty statistics as a ratio of the population from 2006 to 2016 have increased from about 16.8% to more than 19.5%. It is difficult to envision a consumer led exit from the U.S. economic malaise given these statistics. Finance is in the throws of a second “Big Short” for those of you who have seen the movie. Derivatives outstanding within American financial institutions have a face value of more than the world’s total financial assets. Don’t assume that these positions are being managed or regulated by folks smarter and more careful then those in control in 2007. They are not! The cracks are beginning to show and spread whilst the underlying banking assets, severely impaired previously, have yet to be marked to market. Financial institutions are not likely to lead the charge towards a growing economy. In fact, it is more likely we will see a repeat of “The Big Short” in the near future. Government – Helpless – After years of monetary manipulation which accomplished little or nothing the Fed continues to bumble along! There has been little fiscal stimulation and none on the horizon. Helpless!

It is unlikely America will lead the world out of the present morass. With Donald Trump heralded as a hero by the uneducated masses we have only ourselves to thank for the inept economic management of our country. Intelligent leadership seems a dream of the past.

CHINA

What can China do? Nothing. China is in free-fall. Communist dictatorships are not and were never known for forward thinking in economically trying times. China arrests its businessmen, politicians et all (perhaps warranted), closes and manipulates markets, destroys it’s currency, overextends its credit markets in the hope of masking it’s economic catastrophe. It will not lead the world out of recession

EMERGING NATIONS

Emerging nations? Totally dependent on selling natural recourses to China et al. No help there.

EUROPE

Europe? Perhaps the greatest catastrophe on the cusp of discovery. We know that Sovereign debt and bank finance are interdependent. We have seen evidence of that everywhere and evidence of the results when the interdependence breaks down such as in Cyprus and Greece. Neither Cyprus nor Greece is healed with Greece heading for another meaningful debacle. What goes unsaid, for now, is the tightrope the rest of Europe walks. The Southern nations – Italy, Spain and Portugal are on the line of no return with Portugal probably having crossed it. Northern Europe is not far behind with France closest on the heels of the four other significant impending failures. The seriousness of further European defaults to the world economy cannot be overemphasized. With one currency as one nation goes down the rest follow. Diverse currencies allow escapes not available to a large currency block such as the Euro. Compounding the problems of Europe are the long standing banking mores which obfuscate the depth of European banks’ illiquidity and careless lending policies, sometimes bordering on corruption. As regulations and, more so transparency, are enforced on the European banking community it will become apparent that all is not right in the States of Euroland. Prior to the “European Crisis” in, some say 2010 or 2011, practices in play in most banking institutions included reciprocity in lending (you wash my hand I wash yours, we protect each other’s back) - not possible after 2011, careless analysis and regulation as to quality of lending, lassitude as to tracking use of funds (lots of Euros wandered off to the pockets of favored parties), little or no tracking and follow up as to “friend’s loans”, no marks to market or, at least, delayed and inadequate marks against delinquent loans, the creation of vehicles to house gone bad loans which would reduce or eliminate the requirements for mark downs of the bank’s equity, outright conflict of interest and fraudulent transactions. The list is long and goes on but, suffice it to say, the European banking system is awash with mortal problems which are just beginning to surface and are unlikely to be concealed as effectively as in the U.S. – There are too many conflicting political interests within Euroland to preserve the silence of the pack ( the countries and banks themselves.) In the next to last chapter of the book which, I’m afraid, will come out subsequent to the impending crisis we will delineate in detail the methodology by which the many European banks function. It is a lively topic.

In conclusion, 2007-2008 is likely to be repeated in the foreseeable future. This time there are no engines of restoration on the horizon. The catalyst will not be the usual blah blah we read in the financial press. It will be the collapse of the financial structure of Europe, both Sovereign and private. World liquidity, which is strained today, will find its home at “zero”. The recovery will be long and painful.

Asher Edelman

January 12th, 2016

President Obama's State of the Union address as prepared for delivery on Jan. 20, 2015:

Mr. Speaker, Mr. Vice President, Members of Congress, my fellow Americans:

(...)

Now, the truth is, when it comes to issues like infrastructure and basic research, I know there's bipartisan support in this chamber. Members of both parties have told me so. Where we too often run onto the rocks is how to pay for these investments. As Americans, we don't mind paying our fair share of taxes, as long as everybody else does, too. But for far too long, lobbyists have rigged the tax code with loopholes that let some corporations pay nothing while others pay full freight. They've riddled it with giveaways the superrich don't need, denying a break to middle class families who do.

This year, we have an opportunity to change that. Let's close loopholes so we stop rewarding companies that keep profits abroad, and reward those that invest in America. Let's use those savings to rebuild our infrastructure and make it more attractive for companies to bring jobs home. Let's simplify the system and let a small business owner file based on her actual bank statement, instead of the number of accountants she can afford. And let's close the loopholes that lead to inequality by allowing the top one percent to avoid paying taxes on their accumulated wealth. We can use that money to help more families pay for childcare and send their kids to college. We need a tax code that truly helps working Americans trying to get a leg up in the new economy, and we can achieve that together.

On 21 January, 300 heads of state, politicians and public figures, along with 1,500 business leaders from more than 140 countries will gather at the World Economic Forum annual meeting in Davos, Switzerland.

The International Consortium of Investigative Journalists collaborated with more than 80 journalists in 26 countries in its Luxembourg Leaks investigation, exploring the secret tax deals global corporations have made with Luxembourg. For Belgium MO Magazine, De Tijd and Le Soir were involved in the investigation.PricewaterhouseCoopers has helped multinational companies obtain at least 548 tax rulings in Luxembourg from 2002 to 2010. These legal secret deals feature complex financial structures designed to create drastic tax reductions. The rulings provide written assurance that companies’ tax-saving plans will be viewed favorably by Luxembourg authorities.

The International Consortium of Investigative Journalists collaborated with more than 80 journalists in 26 countries in its Luxembourg Leaks investigation, exploring the secret tax deals global corporations have made with Luxembourg. For Belgium MO Magazine, De Tijd and Le Soir were involved in the investigation.PricewaterhouseCoopers has helped multinational companies obtain at least 548 tax rulings in Luxembourg from 2002 to 2010. These legal secret deals feature complex financial structures designed to create drastic tax reductions. The rulings provide written assurance that companies’ tax-saving plans will be viewed favorably by Luxembourg authorities. Companies have channeled hundreds of billions of dollars through Luxembourg and saved billions of dollars in taxes. Some firms have enjoyed effective tax rates of less than 1 percent on the profits they’ve shuffled into Luxembourg.

Many of the tax deals exploited international tax mismatches that allowed companies to avoid taxes both in Luxembourg and elsewhere through the use of so-called hybrid loans.

In many cases Luxembourg subsidiaries handling hundreds of millions of dollars in business maintain little presence and conduct little economic activity in Luxembourg. One popular address – 5, rue Guillaume Kroll – is home to more than 1,600 companies.

Numius werd in 1999 uit de grond gestampt door Geert Hallemeesch en Jo Coutuer, destijds nog onder de naam 'Hallemeesch & Coutuer'. Later voegde ook Thierry Cloetens bij de aandeelhouderstructuur. Vandaag is Numius, een IBM Premier Business Partner, uitgegroeid tot een firma van 33 mensen en een omzet van zo'n 5,5 miljoen euro.

"Deloitte en wijzelf hadden allebei een businessplan over de lange termijn", vertelt Jo Coutuer, managing partner bij Numius. "Na wat gesprekken hebben we beseft dat we ons beider plannen sneller gezamenlijk zouden kunnen verwezenlijken." Het team van de Information Management Service Line van Deloitte Consulting stond vooral sterk in SAP, terwijl Numius voorop liep in IBM. "Ons ook bekwamen in SAP zou jaren gekost hebben", geeft Coutuer toe. "Bovendien waren we zo echt complementair, ook op vlak van klanten." Voorts, zo zegt hij, is de managementstructuur vergelijkbaar en is de manier van diensten aanbieden gelijkaardig. "Numius voegt bovendien zijn business analytics cloudplatform toe en zijn opleidingen via 'Numius Academy'."

De overname heeft voor de klanten van beide bedrijven geen noemenswaardige gevolgen. Intern versmelten de managementstructuren van beide bedrijven. "Beide teams verhuizen binnenkort naar een 'nieuwe zone' in de gebouwen van Deloitte in Diegem, zodat het voor iedereen 'nieuw' is. Juridisch is het wel een overname, maar operationeel zien we het liever als een fusie. De twee teams hebben immers een perfect vergelijkbare omvang." Door het samengaan ontstaat een ploeg van zo'n 75 mensen.

Financieel wilt Coutuer niet teveel details kwijt. "Maar ik wil wel benadrukken dat we door deze overnameovereenkomst veeleer ons risico als ondernemers 'poolen'. Met andere woorden: we blijven ondernemen. Dat het management ook na de overname aan boord blijft - we hebben geen minimumtermijn of iets dergelijks moeten tekenen - bewijst dat volgens mij."

Ik kijk met belangstelling uit naar de volgende afleveringen van dit dossier dat geen dag te vroeg komt. Dit inleidend stuk schetst de contouren waar binnen de Vlaamse Regulator voor de Media (VRM) werkt en legt al meteen de pijnpunten bloot. De VRM houdt hoofdzakelijk economische maatstaven naar dominantie in het oog , Niet dat die niet medebepalend zouden zijn voor de mediaconcentratie in Vlaanderen die trouwens ook op dat vlak groot is .Het feit dat zo’n doorgedreven concentrate zou nodig zijn om onze mediahuizen te laten overleven is een doekje voor het bloeden. Immers, aanvankelijk heeft de taalbarriere er mogelijke buitenlandse investeerders van weerhouden om hier krantenbedrijven op te kopen. Intussen heeft de internationalisering en globalisering van wat men “de media ” is gaan noemen waarvan de printmedia/pers integraal deel is gaan uitmaken, ervoor gezorgd dat ze vroeg of laat volledig in buitenlandse handen kunnen komen . Dat geldt trouwens al voor een aantal, w.o. Sanoma en Telenet. Aan de wetgever om daar wat aan te doen indien hij dat noodzakelijk acht .

Belengrijker lijkt mij dat de VRM in zijn onderzoek een onderscheidt tussen 1. Mediabedrijven die hoofdzakelijk of alleen maar met entertainment bezig of het doorgeefluik ervan (vb. Alfacam, Belgacom, Mobistar, Telenet) ; 2. Persbedriiven die deel uitmaken van een mediabedrijf en welk aandeel ze daarbinnen hebben. Nog niet zo heel lang geleden was een mediabedrijf een

persbedrijf dat dan nog hoofdzakelijk een printmedium was ( kranten, tijdschriften, huis-aan-huisbladen) met bovendien een specifieke journalistieke opdracht als Vierde Macht en garant van de vrijheden en waarden van de democratische rechtstaat. Met de invoering van het allesomvattend begrip “de media” is deze opdracht steeds meer naar de achtergrond verdwenen of zelfs helemaal ondergesneeuwd geraakt. De nieuwe media tycoons zijn obsessioneel bezig met geld en macht en daarin is steeds minder plaats voor onafhankelijke en kritische journalistiek die bovendien hun belangen kan schaden, en op de koop toe handenvol geld kost.

Indien de VRM zijn onderzoek hierop zou toespitsen, wat eigenlijk haar core business zou moeten zijn te meer niemand en zeker niet zijn opdrachtgever de essentiele taak van de pers als Vierde Macht in een democratische rechtsstaat in vraag durft te stelllen ( dat komt misschien nog wel als geld en macht alles dicteert ) , zou het resultaat op zijn zachtst uitgedrukt schokkend zijn vanuit dat oogpunt. De overdreven mediaconcentratie heeft ervoor gezorgd dat de pers een hond is die misschien nog wel mag blaffen maar al lang niet meer kan bijten, laat staan de waakhond zijn waarvoor hij werd opgeleid. Dat vertaalt zich in gemuilkorfde hoofdredacties en redacties waar integriteit en de onafhankelijkheid zijn opgeheven, , zelfcensuur en zelfpromotie schering en inslag zijn uit puur lijfbehoud, de omerta heerst , waar journalisten God en Klein Pierke aan het kruis mogen nagelen vaak op basis van leugens en halve waarheden, bedenkelijke anonieme getuigenissen , zelfs leugens en pure verzinsels . En waar hoofdredacteuren en journalisten spastische stuiptrekkingen krijgen als ze met terechte en verantwoorde mediakritiek te maken krijgen die zelden of nooit hun kolommen haalt tenzij ze er niet langer onderuit kunnen ( zoals bv. tijdens de recente busramp in Zwitserland).

Het is de hoogste tijd dat de VRM daar eens werk van maakt. Want al hebben we geen Vlaamse Berlusconi ( de economische benadering) we hebben wel een Vlaamse Murdoch ( de journalistieke benadering), en al hebben de excessen op dat vlak in Vlaanderen gelukkig nog de schandelijke en zelfs criminele proporties niet bereikt zoals in het wereldrijk van de machtigste man van de wereld Rupert Murdoch, de VRM ( en alle professionele betrokkenen) doet er beter aan het te voorkomen dan het te

moeten genezen. Ik raad hen overigens aan de soap over de wandaden van Murdoch en zijn kornuiten te volgen via de dagelijkse Media Guardian Briefing (info@mail.guardian.co.uk), gratis en voor niks. The Guardian is overigens de Britse kwaliteitskrant die zich meer dan 10 jaar lang vastbeet in de wansmakelijke journalistieke praktijken van de Murdoch-tabloids News of the World (intussen opgedoekt) en The Sun en die uiteindelijk voor zijn uitstekende en volgehouden onderzoeksjournalistiek beloond werd en daarmee het nut en de noodzaak van de pers als Vierde Macht in een democratische rechtsstaat op meesterlijke wijze geillustreerd heeft.

lees meer

Verhofstadt zal in de Rvb van Exmar zetelen naast onder meer ex-Tractebelbaas Philippe Bodson (voorzitter), textielondernemer Philippe Vlerick en François Gillet (Sofina).

Verhofstadt is niet de eerste ex-premier die bestuurder wordt. Jean-Luc Dehaene nam al een aantal mandaten op. Hij is voorzitter bij Dexia en bestuurder bij Thrombogenics, Lotus Bakeries, Umicore en AB InBev. Voormalig premier Mark Eyskens was een tijd voorzitter van chemiebedrijf UCB.(belga)

Het wordt stilaan tijd om de mandaten in kaart te brengen.

De collusie tussen business en politiek is opvallend maar slecht gedocementeerd.

L.Fritz Gruber was born in Cologne on 7th June 1908 and went to School and University there. In 1932 he edited the newspaper Koelner Kurier which was closed down by the authorities and made him emigrate to London where he honed his journalistic skills, until just before the outbreak of war in 1939, when his sick mother recalled him to Germany, where he was trapped by the war, in which he was not eligible to fight, as a result of childhood illness.

During the war he was a studio portrait photographer and had a document-photocopying business in Minden. 1950, to compliment the technical and industrial trade-fair “Photokina”, he initiated the famous Photokina thematic cultural exhibitions, and created 300 in all until 1980. His innovations are countless, he got architects and designers, from Chargesheimer and Michael Sanders to Manfred Heiting and Swoboda to style his exhibitions and he produced their resplendent catalogues, which are now rare, historic, collectors’ items.. He travelled the world to bring new and old applications and manifestations of photography to his exhibitions and met and befriended the great and famous photographers in America, Europe and Asia. I met L. Fritz Gruber at the first international Photokina in 1951. He showed me around his exhibitions and then he came back to London for me to show him around my Festival of Britain. Since then we were best friends for 54 years and travelled and worked together.

He started to collect photographs when he was still at School and his vast, wonderful Gruber-Collection is now the pride of the Ludwig Museum in Cologne. In the 1950s he initiated and made films of still photographs; made early films for TV about photography and photographers, which broke new ground then and inspired the creation of photographic galleries and museums, and he initiated the DGPh, the German Photographic Society.

After his retirement from photokina in 1980, at the age of 72, he continued, right to the end, together with his wife Renate, his dynamic and restless quest for photography, writing articles, producing books and exhibitions, and collecting new and young photographer friends and their photographs. His London years had transformed him into an English gentleman. He was always of striking appearance, immaculately and fashionably dressed, and thus was a favourite subject for photographers, press and TV and was much honoured by them.

L. Fritz Gruber died in Cologne on 30th March 2005. The photogenic light that had illuminated and sparkled up his 96 years through, with and for photography, has finally flickered out. He is survived by his wife Renate and his daughters Anneli and Bettina, the video-artist.

Eric Hobsbawm

America's imperial delusion

The US drive for world domination has no historical precedent

Eric Hobsbawm

Saturday June 14, 2003

The Guardian

The present world situation is unprecedented. The great global empires

of the past - such as the Spanish and notably the British - bear little

comparison with what we see today in the United States empire. A key

novelty of the US imperial project is that all other empires knew that

they were not the only ones, and none aimed at global domination. None

believed themselves invulnerable, even if they believed themselves to be

central to the world - as China did, or the Roman empire. Regional

domination was the maximum danger envisaged until the end of the cold wa

The British empire was the only one that really was global in a sense

that it operated across the entire planet. But the differences are

stark. The British empire at its peak administered one quarter of the

globe's surface. The US has never actually practised colonialism, except

briefly at the beginning of the 20th century. It operated instead with

dependent and satellite states and developed a policy of armed

intervention in these.

The British empire had a British, not a universal, purpose, although

naturally its propagandists also found more altruistic motives. So the

abolition of the slave trade was used to justify British naval power, as

human rights today are often used to justify US military power. On the

other hand the US, like revolutionary France and revolutionary Russia,

is a great power based on a universalist revolution - and therefore on

the belief that the rest of the world should follow its example, or even

that it should help liberate the rest of the world. Few things are more

dangerous than empires pursuing their own interest in the belief that

they are doing humanity a favour.

The cold war turned the US into the hegemon of the western world.

However, this was as the head of an alliance. In a way, Europe then

recognised the logic of a US world empire, whereas today the US

government is reacting to the fact that the US empire and its goals are

no longer genuinely accepted. In fact the present US policy is more

unpopular than the policy of any other US government has ever been, and

probably than that of any other great power has ever been.

The collapse of the Soviet Union left the US as the only superpower. The

sudden emergence of a ruthless, antagonistic flaunting of US power is

hard to understand, all the more so since it fits neither with

long-tested imperial policies nor the interests of the US economy. But

patently a public assertion of global supremacy by military force is

what is in the minds of the people at present dominating policymaking in

Washington.

Is it likely to be successful? The world is too complicated for any

single state to dominate it. And with the exception of its superiority

in hi-tech weaponry, the US is relying on diminishing assets. Its

economy forms a diminishing share of the global economy, vulnerable in

the short as well as long term. The US empire is beyond competition on

the military side. That does not mean that it will be absolutely

decisive, just because it is decisive in localised wars.

Of course the Americans theoretically do not aim to occupy the whole

world. What they aim to do is to go to war, leave friendly governments

behind them and go home again. This will not work. In military terms,

the Iraq war was successful. But it neglected the necessities of running

the country, maintaining it, as the British did in the classic colonial

model of India. The belief that the US does not need genuine allies

among other states or genuine popular support in the countries its

military can now conquer (but not effectively administer) is fantasy.

Iraq was a country that had been defeated by the Americans and refused

to lie down. It happened to have oil, but the war was really an exercise

in showing international power. The emptiness of administration policy

is clear from the way the aims have been put forward in public relations

terms. Phrases like "axis of evil" or "the road map" are not policy

statements, but merely soundbites. Officials such as Richard Perle and

Paul Wolfowitz talk like Rambo in public, as in private. All that counts

is the overwhelming power of the US. In real terms they mean that the US

can invade anybody small enough and where they can win quickly enough.

The consequences of this for the US are going to be very dangerous.

Domestically, the real danger for a country that aims at world control

is militarisation. Internationally, the danger is the destabilising of

the world. The Middle East is far more unstable now than it was five

years ago. US policy weakens all the alternative arrangements, formal

and informal, for keeping order. In Europe it has wrecked Nato - not

much of a loss, but trying to turn it into a world military police force

for the US is a travesty. It has deliberately sabotaged the EU, and also

aims at ruining another of the great world achievements since 1945:

prosperous democratic social welfare states. The crisis over the United

Nations is less of a drama than it appears since the UN has never been

able to do more than operate marginally because of its dependence on the

security council and the US veto.

H ow is the world to confront - contain - the US? Some people, believing

that they have not the power to confront the US, prefer to join it. More

dangerous are those who hate the ideology behind the Pentagon, but

support the US project on the grounds that it will eliminate some local

and regional injustices. This may be called an imperialism of human

rights. It has been encouraged by the failure of Europe in the Balkans

in the 1990s. The division of opinion over the Iraq war showed there to

be a minority of influential intellectuals who were prepared to back US

intervention because they believed it necessary to have a force for

ordering the world's ills. There is a genuine case to be made that there

are governments so bad that their disappearance will be a net gain for

the world. But this can never justify the danger of creating a world

power that is not interested in a world it does not understand, but is

capable of intervening decisively with armed force whenever anybody does

anything that Washington do

How long the present superiority of the Americans lasts is impossible to

say. The only thing of which we can be absolutely certain is that

historically it will be a temporary phenomenon, as all other empires

have been. In the course of a lifetime we have seen the end of all the

colonial empires, the end of the so-called thousand-year empire of the

Germans, which lasted a mere 12 years, the end of the Soviet Union's

dream of world revolution.

There are internal reasons, the most immediate being that most Americans

are not interested in running the world. What they are interested in is

what happens to them in the US. The weakness of the US economy is such

that at some stage both the US government and electors will decide that

it is much more important to concentrate on the economy than to carry on

with foreign military adventures. Even by local business standards Bush

does not have an adequate economic policy for the US. And Bush's

existing international policy is not a particularly rational one for US

imperial interests - and certainly not for the interests of US

capitalism. Hence the divisions of opinion within the US government.

The key questions now are: what will the Americans do next, and how will

other countries react? Will some countries, like Britain, back anything

the US plans? Their governments must indicate that there are limits. The

most positive contribution has been made by the Turks, simply by saying

there are things they are not prepared to do, even though they know it

would pay. But the major preoccupation is that of - if not containing -

educating or re-educating the US. There was a time when the US empire

recognised limitations, or at least the desirability of behaving as

though it had limitations. This was largely because the US was afraid of

somebody else: the Soviet Union. In the absence of this kind of fear,

enlightened self-interest and education have to take over.

This is an extract of an article edited by Victoria Brittain and

published in Le Monde diplomatique's June English language edition. Eric

Hobsbawm is the author of Interesting Times, The Age of Extremes and The

Age of Empire

zie: www.mondediplo.com